About

Founded in 1989, PanAgora Asset Management decided long ago to build a unique, forward-looking investment firm underpinned by insightful research, innovation and creativity. These same qualities that informed our value proposition over 30 years ago remain more important than ever today, as we seek to deliver attractive, risk-adjusted returns on behalf of our clients.

At PanAgora, we are committed to providing clients with reliable investment processes, transparency and access to the firm’s network of resources. We pride ourselves on our time-tested investment approach and our team— comprised of leading academics and experienced investment professionals— all of whom are entrenched in the day-to-day oversight of our clients’ investments. We believe that senior-level, hands-on oversight, combined with our singular focus on seeking to develop and implement distinctive, Active Equity and Multi Asset strategies, provides us with the capability to offer diversified and tailored investment solutions designed to help clients achieve their financial objectives and be prepared for tomorrow’s evolving investment landscape.

Learn More About Our ApproachAt a Glance

Ownership

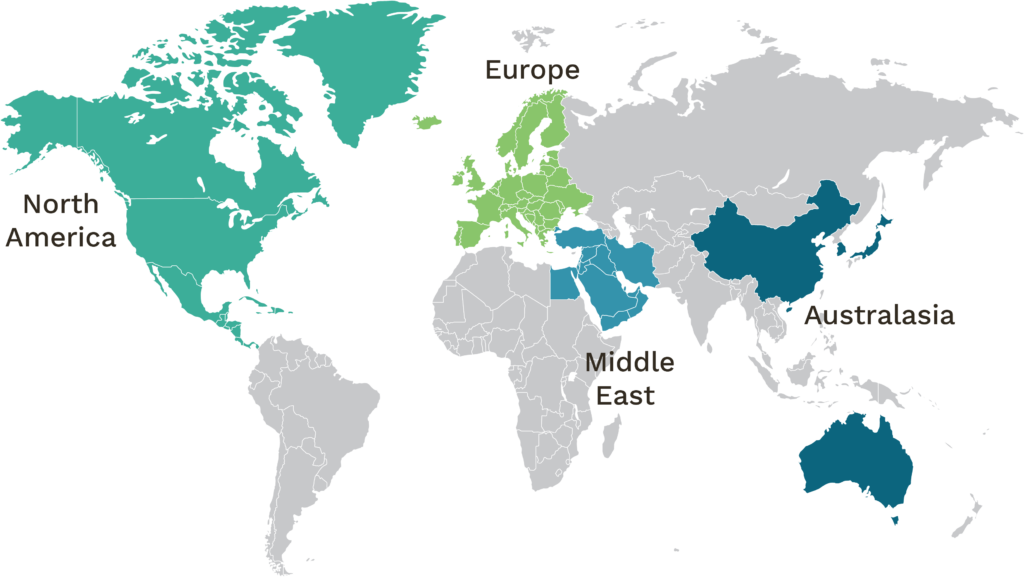

Global Investor Base

Products and services referenced herein may not be available for persons located in certain countries. Information and functionality including hyperlinks contained within are not directed at or intended for use by any person located in any jurisdiction where the distribution of such information is contrary to the laws of such jurisdiction.

All ownership interests of PanAgora are held by PanAgora employees and Great-West Lifeco Inc. (“GWL”), indirectly through its subsidiaries, including Empower. Specifically, PanAgora employees may own up to 20% of PanAgora’s economic interests via PanAgora’s Management Equity Plan. All residual economic interests of PanAgora, as well as all of PanAgora’s voting interests, are held by GWL. Power Corporation of Canada, indirectly through its subsidiaries, owns a majority of GWL’s voting interests.

*Power Corporation of Canada is an international management and holding company that focuses on financial services in North America, Europe and Asia. Its core holdings are leading insurance, retirement, wealth management and investment businesses, including a portfolio of alternative asset investment platforms.